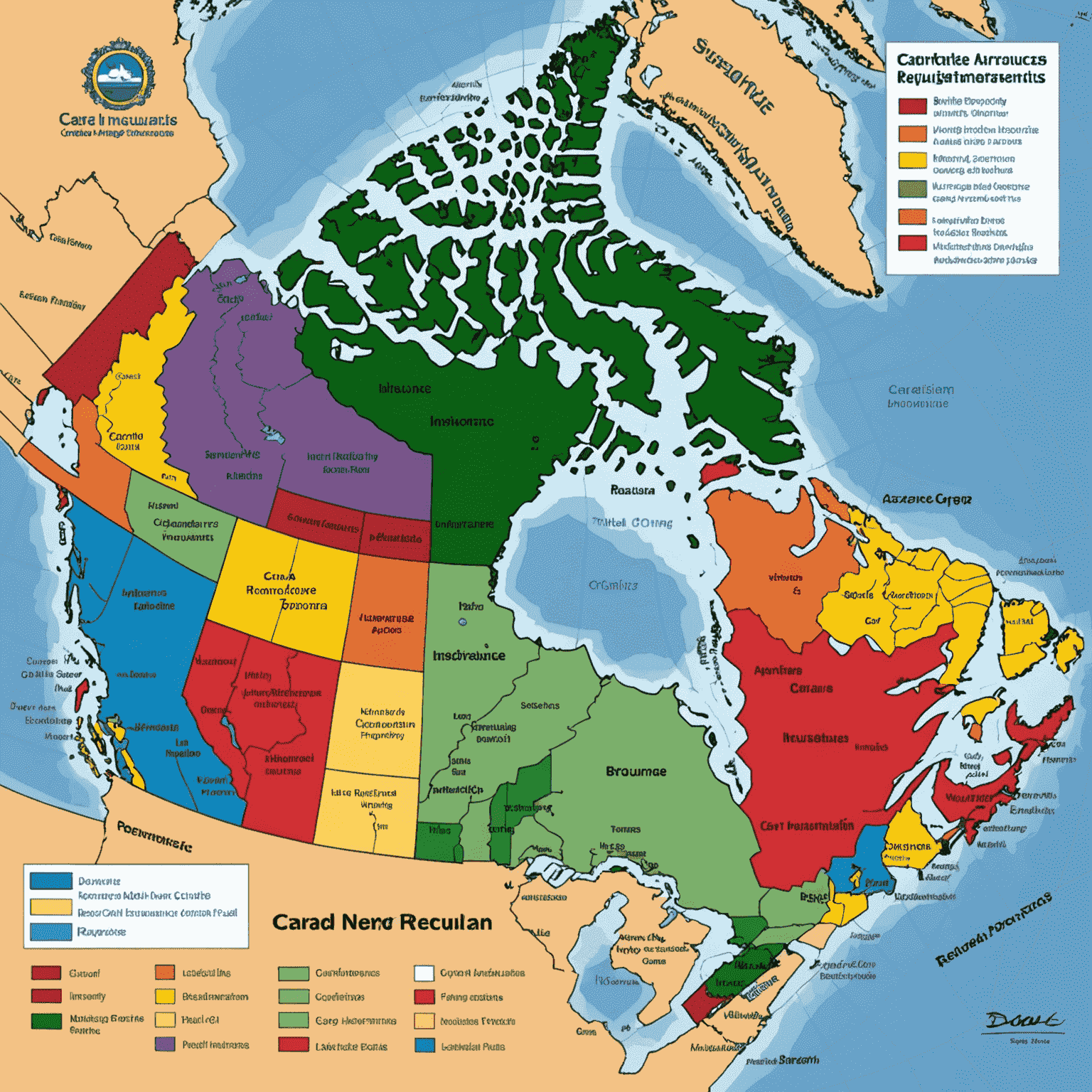

Provincial Regulations for Car Insurance in Canada

Understanding the specific car insurance requirements and regulations for each Canadian province and territory is crucial when choosing the best policy for your needs. Let's explore the key differences across Canada.

Ontario

Ontario requires all drivers to have a minimum of $200,000 in third-party liability coverage. Additional mandatory coverages include statutory accident benefits, direct compensation property damage, and uninsured automobile coverage.

British Columbia

In BC, basic auto insurance is provided by the Insurance Corporation of British Columbia (ICBC). The minimum third-party liability coverage is $200,000, and additional coverages like collision and comprehensive are optional.

Alberta

Alberta mandates a minimum of $200,000 in third-party liability coverage. Accident benefits and direct compensation for property damage are also required. Optional coverages include collision and comprehensive.

Quebec

Quebec has a unique system where bodily injury coverage is provided by the government, while property damage liability (minimum $50,000) must be purchased from private insurers. Additional coverages are optional.

Manitoba and Saskatchewan

Both provinces have public insurance systems. Basic coverage is mandatory and provided by Manitoba Public Insurance (MPI) and Saskatchewan Government Insurance (SGI) respectively. Additional coverage can be purchased from private insurers.

Atlantic Provinces

New Brunswick, Nova Scotia, Prince Edward Island, and Newfoundland and Labrador all require a minimum of $200,000 in third-party liability coverage. Other mandatory and optional coverages may vary slightly between provinces.

Territories

Yukon, Northwest Territories, and Nunavut generally follow similar regulations to the provinces, with minimum liability coverage of $200,000. However, due to their unique geographical challenges, additional considerations may apply.

Important Note

While these are the minimum requirements, it's often recommended to consider higher coverage limits and additional protections based on your individual needs and circumstances. Always consult with a licensed insurance professional to ensure you have the right car insurance policy for your situation.